Insurance companies often cover weight loss surgery for qualified individuals, recognizing the health benefits. Some insurers include Aetna, Cigna, UnitedHealth Group, and Humana.

Weight loss surgery can be a life-changing procedure for individuals struggling with obesity, but the cost can be a significant barrier for many. Understanding which insurance plans cover weight loss surgery can make it more accessible to those in need.

Whether it’s gastric bypass, sleeve gastrectomy, or lap-band surgery, having the right insurance coverage can ease the financial burden and make this important healthcare option available to more people. By knowing which insurance companies offer coverage for weight loss surgery, individuals can take steps towards improving their health and quality of life.

Importance Of Insurance Coverage

Insurance coverage plays a crucial role in enabling individuals to undergo weight loss surgery, which can significantly impact their health and well-being.

Commonly Covered Procedures

Insurance providers typically cover procedures such as Gastric Sleeve, Gastric Bypass, Distal Bypass, and Lap-Band Removal for qualifying individuals seeking weight loss surgery.

Eligibility For Insurance Coverage

Before undergoing weight loss surgery, it is crucial to understand if your insurance plan covers the procedure. Most insurance companies do recognize the health risks associated with obesity and provide coverage for weight loss surgeries if certain qualifications are met. Here’s a closer look at the eligibility criteria:

Qualification Requirements

- Body Mass Index (BMI) above a certain threshold

- Evidence of unsuccessful attempts at traditional weight loss methods

- Documentation of weight-related health issues

- Physician recommendation for weight loss surgery

Criteria For Coverage

| Insurance Provider | Covered Procedures |

|---|---|

| Aetna | Gastric Sleeve, Gastric Bypass, Distal Bypass, Lap-Band Removal |

| Anthem Blue Cross Blue Shield | Gastric Bypass |

| Medicare | Gastric Bypass, Laparoscopic Banding |

It’s essential to check with your insurance carrier to confirm coverage details specific to your plan. Patients can work with their healthcare provider to determine if they meet the necessary requirements for insurance coverage of weight loss surgery.

Insurance Company Coverage

Insurance companies often cover weight loss surgery to address the health risks of obesity, provided patients meet specific criteria. Procedures like gastric sleeve and bypass may be covered by various insurers, including major carriers like Aetna, Cigna, and UnitedHealth Group.

Insurance Company Coverage

When considering weight loss surgery, understanding your insurance coverage is crucial. Different insurance companies have varying policies and coverage for weight loss surgeries. It’s important to explore the specifics of each insurance provider to determine the extent of coverage and eligibility criteria. Here’s an overview of the coverage offered by some major insurance companies:

Aetna Coverage

Aetna offers coverage for weight loss surgeries, including gastric bypass, gastric sleeve, and lap band procedures, under certain circumstances. The coverage extends to qualifying individuals, subject to specific criteria and guidelines set by Aetna.

Cigna Group Coverage

Cigna Group provides coverage for weight loss surgery. They have specific requirements and criteria for eligibility, and the coverage is extended to eligible members after fulfilling the necessary prerequisites.

UnitedHealth Group Inc Coverage

UnitedHealth Group Inc offers coverage for weight loss surgeries such as gastric bypass and laparoscopic sleeve gastrectomy. The coverage is available to eligible members who meet the outlined criteria and prerequisites.

Humana Coverage

Humana provides coverage for weight loss surgery to eligible members who meet the stipulated criteria. The coverage includes various weight loss procedures, subject to the specific guidelines and requirements set forth by Humana.

Understanding the coverage provided by these insurance companies is crucial when considering weight loss surgery. It’s essential to carefully review the specific policies and requirements outlined by each insurer to make informed decisions regarding your weight loss surgery options.

Coverage By State

A major consideration for individuals seeking weight loss surgery is whether their insurance covers the procedure. Insurance coverage can vary by state, so it’s important to understand the specific policies and regulations in your area. In this section, we will explore the coverage options for weight loss surgery in two states: Texas and California.

Texas Coverage

In Texas, there are several insurance providers that offer coverage for weight loss surgery. Some of the major carriers include Aetna, Blue Cross Blue Shield, UnitedHealthcare, and Cigna. These insurance companies recognize the health risks associated with obesity and understand the benefits of weight loss surgery as a treatment option.

| Insurance Provider | Coverage |

|---|---|

| Aetna | Aetna offers coverage for weight loss surgery, including gastric bypass, gastric sleeve, and lap band procedures. |

| Blue Cross Blue Shield | Blue Cross Blue Shield of Texas provides coverage for weight loss surgery, with certain criteria and qualifications. |

| UnitedHealthcare | UnitedHealthcare offers coverage for weight loss surgery, including gastric bypass and gastric sleeve procedures. |

| Cigna | Cigna provides coverage for weight loss surgery, including gastric bypass, gastric sleeve, and lap band procedures. |

It’s important to note that each insurance provider may have specific requirements and qualifications for weight loss surgery coverage. It’s advisable to consult with your insurance company or a healthcare professional to understand the details of your coverage.

California Coverage

In California, there are also several insurance providers that offer coverage for weight loss surgery. Some of the major carriers include Anthem Blue Cross, Kaiser Permanente, Blue Shield of California, and Health Net. These insurance companies recognize the medical necessity of weight loss surgery and provide coverage for eligible individuals.

| Insurance Provider | Coverage |

|---|---|

| Anthem Blue Cross | Anthem Blue Cross offers coverage for weight loss surgery, including gastric bypass and gastric sleeve procedures. |

| Kaiser Permanente | Kaiser Permanente provides coverage for weight loss surgery, including gastric bypass and gastric sleeve procedures. |

| Blue Shield of California | Blue Shield of California offers coverage for weight loss surgery, with certain criteria and qualifications. |

| Health Net | Health Net provides coverage for weight loss surgery, including gastric bypass and gastric sleeve procedures. |

As with Texas, it’s important to review the specific requirements and qualifications of your insurance provider in California. Consulting with your insurance company or a healthcare professional will help you understand the details of your coverage.

Options For Affording Surgery

Many insurance companies recognize the health threats of obesity and do cover weight loss surgery as long as the qualification requirements are met. Fortunately, there are options to afford weight loss surgery through various insurance providers. Medicaid and Medicare also cover some bariatric procedures, including gastric bypass surgery and laparoscopic banding surgery, for eligible patients.

Using Insurance Benefits

If you’re considering weight loss surgery, using your insurance benefits can be a great option to help cover the costs. Many insurance companies recognize the health risks associated with obesity and provide coverage for weight loss surgery. However, it’s important to note that each insurance plan may have different criteria and requirements for coverage.

To determine if your insurance covers weight loss surgery, start by evaluating your insurance plan. Review the policy documents or contact your health insurance provider directly to understand the coverage options available to you. It’s also a good idea to consult with your healthcare provider, who can provide guidance on navigating the insurance approval process.

Once you’ve gathered all the necessary information, you may need to submit a prior authorization request to your insurance company. This request should include all relevant medical records, documentation of previous weight loss attempts, and any other required documents outlined by your insurance provider. After submitting the request, be sure to follow up on its processing to ensure timely approval.

Out-of-pocket Options

If your insurance doesn’t cover weight loss surgery or if you don’t have insurance, there are still out-of-pocket options available to help you afford the procedure. Many weight loss surgery clinics offer financing plans that allow you to pay for the surgery over time. These plans often come with flexible payment options and low-interest rates to make the procedure more financially manageable.

Additionally, some medical facilities offer self-pay options for weight loss surgery. This means you pay for the procedure yourself without involving insurance. While this can be expensive upfront, it may be a viable option for those who can afford it or have been denied insurance coverage.

It’s also worth exploring other resources for financial assistance, such as grants or fundraising platforms specifically designed to support individuals seeking weight loss surgery. With these options, it’s important to research and carefully consider the terms and conditions to ensure they align with your financial situation and goals.

Remember, when it comes to affording weight loss surgery, exploring all your options, including insurance benefits and out-of-pocket options, can increase your chances of finding a solution that works for you.

Credit: www.obesityaction.org

Navigating The Approval Process

Getting insurance approval for weight loss surgery can be a complex and confusing process. However, understanding the key steps and requirements can make this journey smoother. Successfully navigating the approval process involves seeking approval, gathering necessary documents, and following up diligently.

Seeking Approval

Initially, it’s crucial to determine if your insurance plan covers weight loss surgery. Review your policy or contact your insurance provider to understand the specific requirements and criteria for approval.

Gathering Necessary Documents

Upon confirming coverage, the next step involves gathering essential documents such as medical records, physician evaluations, and proof of previous weight loss attempts. Ensuring all required documentation is complete and accurate is vital in expediting the approval process.

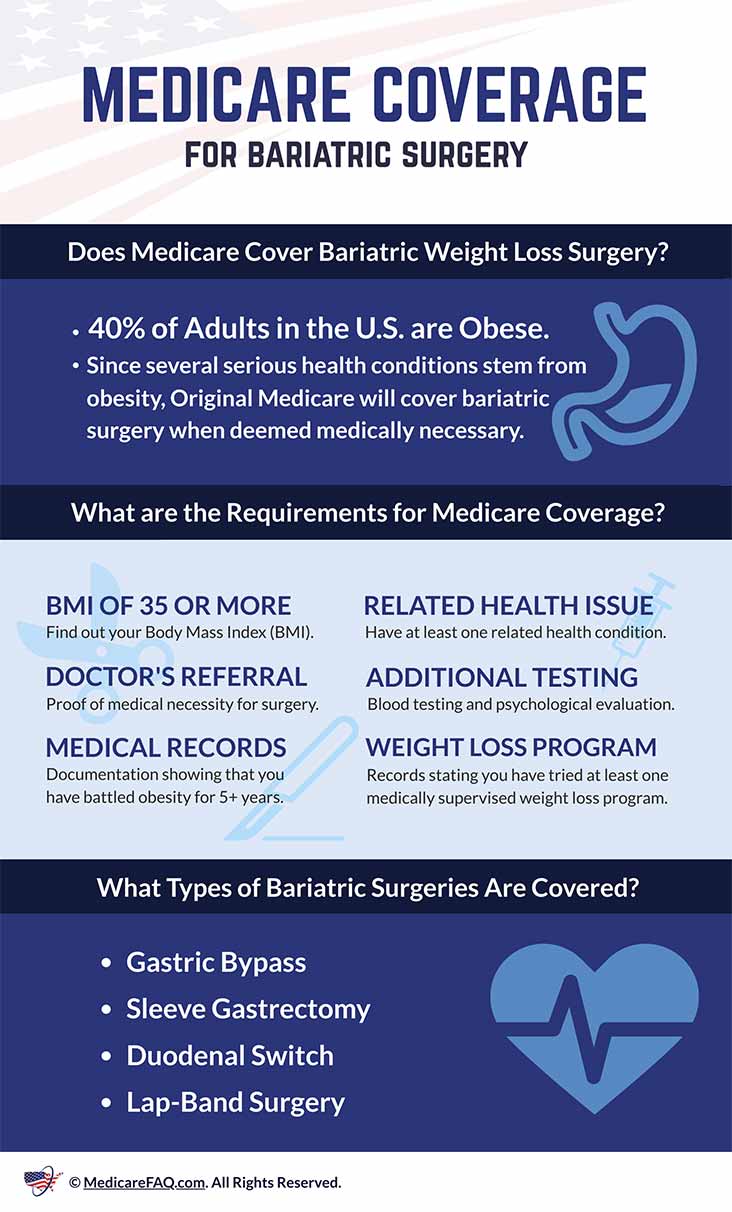

Medicare And Medicaid Coverage

Medicare and Medicaid play crucial roles in covering bariatric procedures for individuals seeking weight loss surgery. Understanding the qualifications and procedures covered by these government insurance programs is essential for those considering such surgeries.

Bariatric Procedures Covered

- Gastric bypass surgery

- Laparoscopic banding surgery

Qualification Criteria

Qualifying for weight loss surgery under Medicare and Medicaid typically involves meeting specific criteria such as having a BMI above a certain threshold and demonstrating previous attempts at weight loss through diet and exercise.

Seeking Insurance Approval For Specific Surgeries

Insurance coverage for weight loss surgery varies among different insurance companies, but many recognize the health dangers of obesity and offer coverage as long as qualification requirements are met. Patients can contact their insurance provider, gather necessary documents, and follow the approval process to seek insurance approval for specific surgeries.

Gastric Sleeve Approval

Obtaining approval from your insurance provider for a gastric sleeve procedure is critical for ensuring coverage.

Gastric Bypass Approval

Securing insurance approval for a gastric bypass surgery involves fulfilling specific criteria set by your insurance plan.

Lap-band Removal Approval

Approval for lap-band removal by your insurance requires submitting the necessary documentation and meeting the criteria outlined.

Coverage Considerations

When considering weight loss surgery, understanding the insurance coverage for such procedures is crucial. Coverage considerations can vary depending on individual policy differences and specific requirements set by insurance providers. It is essential to comprehend these aspects to ensure that the weight loss surgery is covered by the insurance plan. Let’s delve into the factors to consider under Coverage Considerations.

Individual Policy Differences

Insurance companies may have varying policies regarding weight loss surgery coverage. Some insurers may offer comprehensive coverage for bariatric procedures, while others may have specific criteria that need to be met for coverage to apply. Understanding the individual policy differences of insurance providers is essential in determining the extent of coverage available for weight loss surgery.

Understanding Requirements

Insurance providers typically have specific requirements that need to be met for weight loss surgery to be covered under their policies. These requirements may include factors such as the patient’s body mass index (BMI), documented history of failed attempts at traditional weight loss methods, and pre-authorization from a healthcare provider. Understanding these requirements is crucial in ensuring that the necessary criteria are fulfilled to qualify for insurance coverage.

Limitations And Exclusions

While many insurance companies do cover weight loss surgery, it’s important to understand that there may be limitations and exclusions to consider. These limitations and exclusions outline the specific criteria that must be met in order for insurance coverage to be approved for weight loss surgery.

Bariatric Exclusions

Some insurance policies have specific exclusions for bariatric surgery. This means that weight loss surgery may not be covered under certain insurance plans. It’s important to carefully review your insurance policy to determine if bariatric surgery is excluded. However, even if your policy does exclude this type of surgery, there may still be alternative options available to help you afford the procedure.

Ozempic Approval

When it comes to getting approval for weight loss surgery, insurance companies may require specific steps and documentation. In some cases, insurance providers may request the approval of a medication called Ozempic, which is used to help with weight loss. It’s important to evaluate your insurance plan and contact your health insurance provider to understand their requirements and guidelines for getting Ozempic approved.

To increase your chances of getting Ozempic approved for weight loss surgery, consult with your healthcare provider to determine if this medication is appropriate for you. Gather all the necessary documents and send in a prior authorization request to your insurance provider. It’s important to follow up on the progress of your request to ensure it is being processed in a timely manner.

Remember, each insurance provider may have different requirements, so it’s essential to familiarize yourself with your specific insurance plan and its coverage for weight loss surgery. By understanding the limitations and exclusions within your policy and following the necessary steps, you can navigate the insurance process more effectively and increase your chances of getting coverage for weight loss surgery.

In-network Insurance Providers

When it comes to weight loss surgery, insurance coverage can play a crucial role in determining your options and costs. In-network insurance providers are those that have established agreements with specific healthcare providers to provide services at discounted rates. This means that if you choose a surgeon or hospital that is in-network with your insurance provider, you may receive the maximum insurance coverage for your weight loss surgery.

Ppo Coverage

One of the most common types of insurance plans that offer coverage for weight loss surgery is the Preferred Provider Organization (PPO) plan. PPO plans allow you the flexibility to choose your healthcare providers, including surgeons and hospitals, both in and out of your insurance network. However, it’s important to note that staying in-network can significantly reduce your out-of-pocket expenses.

List Of Covered Procedures

If you have a PPO plan, many insurance providers are now offering coverage for various weight loss procedures. Here’s a list of some of the commonly covered procedures:

| Procedure | In-Network Insurance Providers |

|---|---|

| Gastric Sleeve | Aetna, Anthem Blue Cross Blue Shield, UnitedHealth Group Inc, Humana |

| Gastric Bypass | Aetna, Anthem Blue Cross Blue Shield, UnitedHealth Group Inc, Humana |

| Distal Bypass | Aetna, Anthem Blue Cross Blue Shield, UnitedHealth Group Inc, Humana |

| Lap-Band Removal | Aetna, Anthem Blue Cross Blue Shield, UnitedHealth Group Inc, Humana |

It’s important to keep in mind that coverage may vary depending on your specific insurance plan and individual policy. To get the most accurate information about your coverage, it’s recommended to contact your insurance provider directly and inquire about the specific weight loss procedures that are covered under your plan.

Remember, understanding your insurance coverage is the first step in the weight loss surgery journey. By choosing a surgeon and hospital that are in-network with your insurance provider, you can maximize your insurance coverage and minimize your out-of-pocket expenses.

Seeking Insurance Information From Service Providers

When seeking weight loss surgery, navigating the insurance process can be a crucial step in securing coverage for the procedure. Understanding which insurance providers are accepted by various service providers is essential in ensuring a smooth journey towards bariatric surgery. Here’s an overview of the insurance coverage offered by some prominent service providers:

Bmi Of Texas

BMI of Texas is in network with most major insurance carriers. They offer comprehensive coverage for weight loss surgery, making it accessible to a wide range of individuals seeking treatment for obesity.

Understanding Bariatric Surgery And Insurance

Insurance companies recognize the health risks of obesity. Weight loss surgery is covered if you meet the requirements.

Many PPO providers now cover procedures like Gastric Sleeve, Gastric Bypass, Distal Bypass, and Lap-Band Removal.

Process For Obtaining Approval

The Process for Obtaining Approval: When considering weight loss surgery, navigating insurance coverage can be a crucial aspect of the journey. Understanding the process for obtaining approval is essential to ensure a smooth and successful experience.

Prior Authorization

Before proceeding with weight loss surgery, it’s crucial to obtain prior authorization from your insurance provider. This involves submitting a request that outlines the medical necessity of the procedure and provides all required documentation.

Follow-up Process

After submitting your prior authorization request, it is important to follow up with your insurance provider to track the progress of your approval. Regular communication and documentation may be needed to expedite the approval process.

Network Coverage

When considering weight loss surgery, it’s crucial to ensure your insurance provider has network coverage to support these life-changing procedures. Here are some notable networks that offer comprehensive coverage for weight loss surgery:

Texas Bariatric Specialists

For individuals in Texas, Texas Bariatric Specialists can be a valuable network to consider for weight loss surgery coverage. This network is renowned for its commitment to providing access to quality bariatric care, ensuring that patients have the necessary support and resources throughout their weight loss journey.

Sutter Health

Sutter Health is another prominent network recognized for its coverage of weight loss surgery. With a focus on delivering exceptional healthcare services, Sutter Health strives to make weight loss surgery accessible and affordable for individuals seeking transformative solutions.

Understanding Medicare And Medi-cal Coverage

When it comes to weight loss surgery, understanding your insurance coverage is crucial. For individuals who qualify for Medicare or Medi-Cal, there may be some coverage available to help with the costs of these procedures. Let’s take a closer look at the qualification criteria and covered procedures for Medicare and Medi-Cal.

Qualification Criteria

Before considering weight loss surgery coverage under Medicare or Medi-Cal, it’s important to understand the qualification criteria. These programs have specific requirements that individuals must meet in order to be eligible for coverage.

With Medicare, the qualification criteria for weight loss surgery coverage include having a body mass index (BMI) of 35 or higher, having at least one weight-related medical condition, and proof of unsuccessful attempts at traditional weight loss methods.

On the other hand, Medi-Cal follows similar qualification criteria for weight loss surgery coverage. Individuals must have a BMI of 35 or higher, have at least one weight-related medical condition, and show proof of unsuccessful attempts at traditional weight loss methods.

Covered Procedures

Medicare and Medi-Cal offer coverage for certain weight loss surgery procedures that meet their guidelines. Here are some of the covered procedures:

- Gastric bypass surgery

- Laparoscopic banding surgery

- Gastric sleeve surgery

It’s important to note that not all weight loss surgery procedures may be covered by Medicare or Medi-Cal. However, these programs typically cover the most common and effective procedures for significant weight loss.

If you’re considering weight loss surgery and have Medicare or Medi-Cal coverage, it’s essential to consult with your healthcare provider and insurance representative to understand the specifics of your coverage. They can provide you with detailed information about the covered procedures, eligibility requirements, and any additional steps you may need to take.

Customizing Approaches For Insurance Approval

Insurance coverage for weight loss surgery varies among different insurance companies. However, many insurance providers do recognize the health risks associated with obesity and offer coverage for weight loss surgery as long as certain qualification requirements are met. If you are considering weight loss surgery, it is essential to evaluate your insurance plan, contact your health insurance provider, consult with your healthcare provider, gather necessary documents, and submit a prior authorization request to increase your chances of approval.

Insurance Plan Evaluation

Before delving into the process of obtaining insurance approval for weight loss surgery, it is crucial to evaluate your insurance plan. Each insurance company has its own set of guidelines and coverage criteria for weight loss surgery. Verify if your insurance plan covers bariatric procedures and if there are any specific requirements that need to be met.

Healthcare Provider Consultation

Consulting with your healthcare provider is an essential step in customizing your approach for insurance approval. Your healthcare provider will guide you through the process, assess your eligibility for weight loss surgery, and provide the necessary documentation to support your case. They will have a deep understanding of your medical history and can address any concerns raised by the insurance company.

Gather The Necessary Documents

Once you have verified your insurance coverage and consulted with your healthcare provider, gather all the necessary documents required by your insurance company. These documents may include medical records, previous weight loss attempts, documentation of comorbidities, and a letter of medical necessity. Make sure to organize these documents in a clear and concise manner, ensuring that all the relevant information is easily accessible to the insurance company.

Submit A Prior Authorization Request

To initiate the insurance approval process, you will need to submit a prior authorization request to your insurance company. This request outlines the medical necessity of the weight loss surgery and provides supporting documents to strengthen your case. Be sure to follow the specific guidelines provided by your insurance company regarding the submission of the prior authorization request.

Follow Up On Your Request Processing

After submitting the prior authorization request, it is important to follow up on the status of your request. Stay proactive and contact your insurance company to check the progress of your request. This will help you stay informed and ensure that there are no delays or additional requirements needed for approval.

By customizing your approach for insurance approval, you can increase the likelihood of securing coverage for weight loss surgery. Take the time to evaluate your insurance plan, consult with your healthcare provider, gather the necessary documentation, submit a prior authorization request, and consistently follow up on the progress. With determination and persistence, you can navigate the insurance approval process and take the first steps towards improving your health and well-being.

Credit: www.medicarefaq.com

Exploring Coverage In Different States

Considering the differences in healthcare coverage across different states, the availability of insurance coverage for weight loss surgery varies. Many insurance companies recognize the health risks of obesity and provide coverage for weight loss surgeries, depending on specific qualification requirements.

Patients are advised to thoroughly evaluate their insurance plans and consult healthcare providers to determine coverage eligibility.

Texas Coverage Details

In Texas, many insurance providers offer coverage for weight loss surgeries such as Gastric Sleeve, Gastric Bypass, Distal Bypass, and Lap-Band Removal. BMI of Texas is in-network with most major insurance carriers, providing various options for individuals seeking bariatric surgery coverage in Texas.

California Coverage Details

Similarly, both Medicare and Medicaid cover certain bariatric procedures in California, including gastric bypass surgery and laparoscopic banding surgery. Patients who meet the eligibility requirements can benefit from insurance coverage for their weight loss surgeries in California.

By understanding the coverage details in different states, individuals can make informed decisions about their weight loss surgery options. As insurance coverage varies among states, it’s important for individuals to research and consult with healthcare providers and insurance companies to determine the available coverage options for their specific locations.

Understanding Policy Coverage For Weight Loss Surgery

Insurance coverage for weight loss surgery varies among providers, with many companies recognizing the health risks of obesity. Qualification requirements must be met for approval, but numerous insurance plans now cover procedures like gastric sleeve and bypass. It’s essential to check with your insurer and healthcare provider for specific coverage details.

Exclusions And Inclusions

Insurance policies for weight loss surgery may have specific exclusions and inclusions that patients need to be aware of before proceeding with the procedure.

Policy Variations

There are variations in policy coverage across different insurance providers when it comes to weight loss surgeries. It is crucial to understand these variations to determine if your surgery will be covered.

Credit: jetmedicaltourism.com

Frequently Asked Questions On What Insurances Cover Weight Loss Surgery

Do Most Insurance Companies Cover Weight Loss Surgery?

Many insurance companies cover weight loss surgery to address obesity-related health risks. Check with your provider for specifics.

How Do I Get Approval For Weight Loss Surgery?

To get approval for weight loss surgery, consult with a healthcare provider to ensure you meet the qualification requirements. Contact your insurance provider and gather necessary documents for a prior authorization request. Many insurance companies cover weight loss surgery for individuals who meet the criteria.

How Do People Afford Weight Loss Surgery?

Many insurance companies cover weight loss surgery if you meet the qualification requirements. You can also evaluate your insurance plan, contact your provider, consult with your healthcare provider, gather necessary documents, and submit a prior authorization request. Some insurance plans may cover procedures like gastric bypass and laparoscopic banding surgery.

How Do I Get My Insurance To Approve Ozempic?

To get your insurance to approve Ozempic for weight loss, follow these steps: 1. Evaluate your insurance plan. 2. Contact your health insurance provider. 3. Consult with your healthcare provider. 4. Gather the necessary documents. 5. Send in a prior authorization request.

Do Most Insurance Companies Cover Weight Loss Surgery?

Fortunately, many insurance companies recognize the serious health threats of obesity and do cover weight loss surgery as long as you meet the qualification requirements.

Conclusion

Understanding the coverage options for weight loss surgery is essential for individuals seeking treatment. Many insurance companies do cover these procedures, provided that certain qualifications are met. By navigating through the available coverage options and consulting with healthcare providers, individuals can take steps towards accessing these potentially life-changing surgeries.

With the right information and support, the path to obtaining insurance coverage for weight loss surgery can become more manageable.

Read more: What Causes Rapid Weight Loss in Cats?

Leave a Reply